Calculate the Estimated Total Manufacturing Overhead Cost for Each Department

Use these four steps to compute total manufacturing costs for a product or business. Assembly Department Overhead Cost Y.

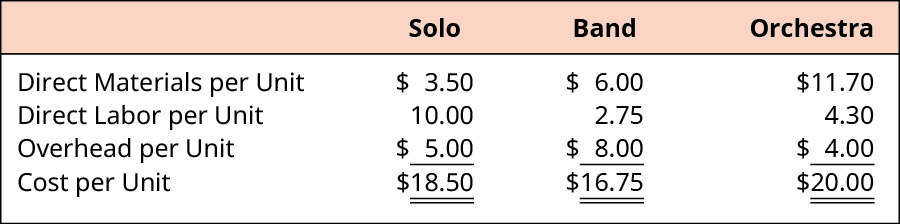

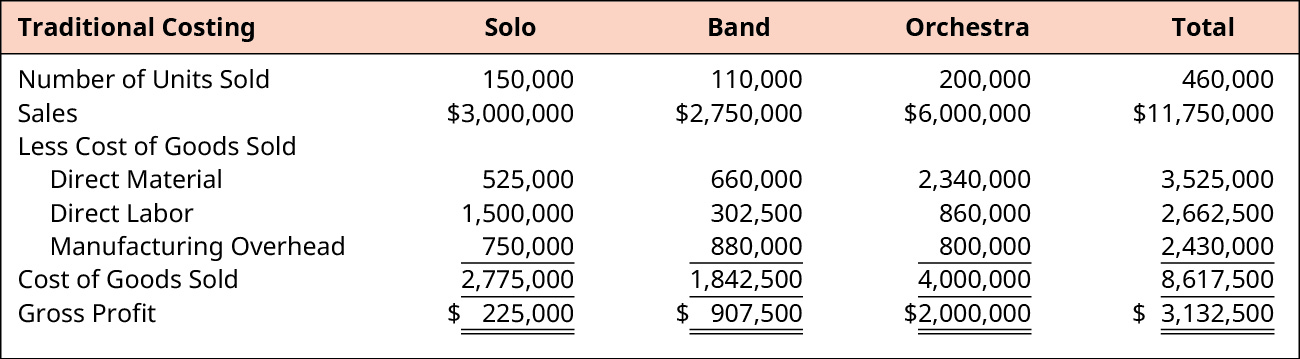

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Do not use in your answer.

. 800 per direct labor hour. To find the manufacturing overhead per unit In order to know the manufacturing overhead cost to make one unit divide the total manufacturing overhead by. Predetermined overhead rate est.

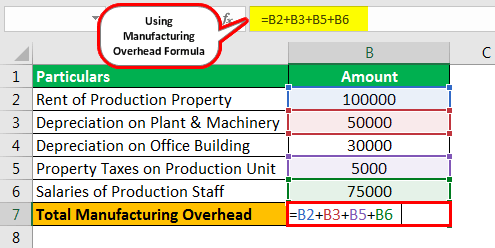

Predetermined OH allocation rate x Actual qty of the allocation base. Therefore the calculation of manufacturing overhead is as follows 7141500 14283000 10712250 714150. Material costs of respective cost centers.

The cost of goods sold consists of direct materials of 350 per unit direct labor of 10 per unit and manufacturing overhead of 500 per unit. The first step to calculate the overhead rate is to determine the activity-level to be used for the base selected and then estimate or budget each individual expense at the estimated activity level in order to arrive at the total estimated overhead. Manufacturing Overhead Rate Overhead Costs Sales x 100.

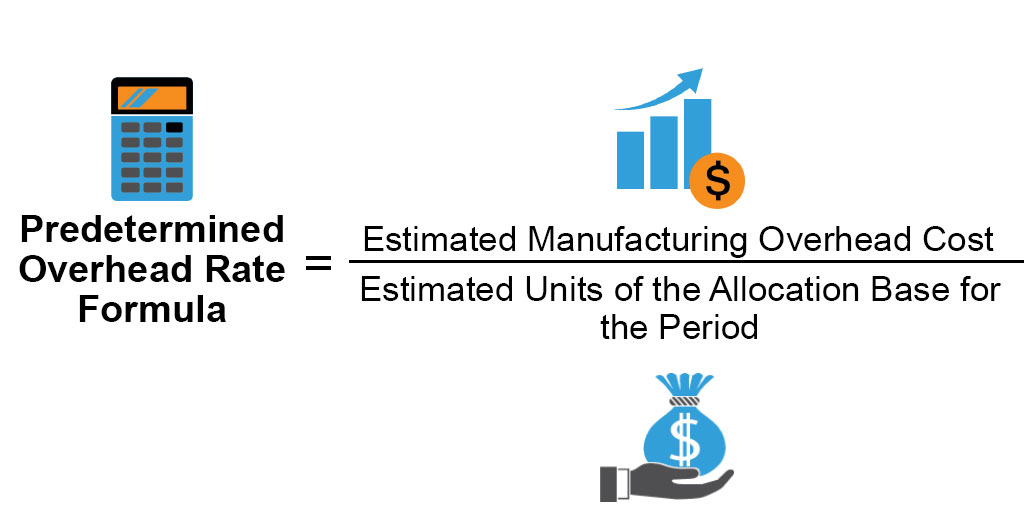

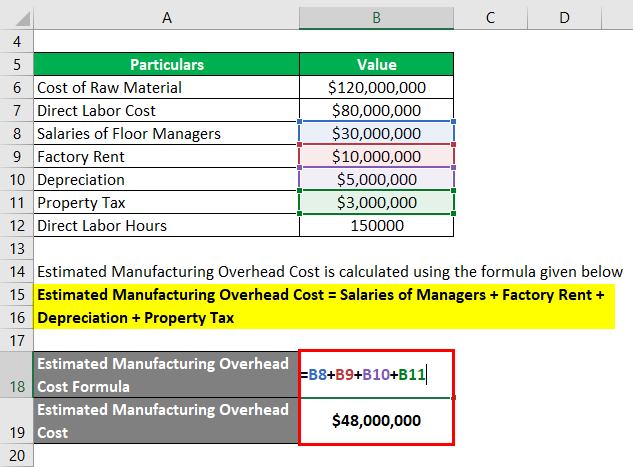

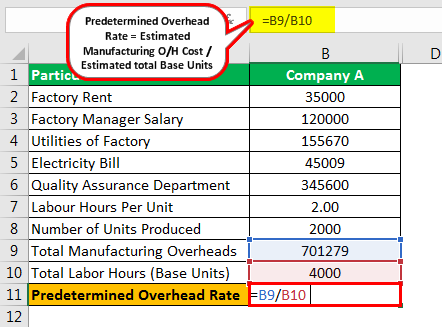

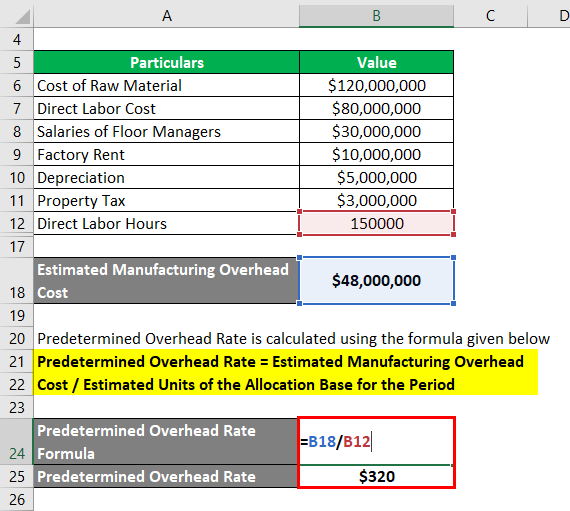

Predetermined Overhead Rate Estimated Manufacturing Overhead Cost Estimated Units of the Allocation Base for the Period. Estimating the Activity Level and Expenses. Estimated total manufacturing overhead cost Estimated total fixed manufacturing overhead cost Estimated variable overhead cost per unit of the allocation base Estimated total amount of the allocation base 455000 500 per machine-hour 32500 machine-hours 455000 162500 617500.

Notice that the formula of predetermined overhead rate is entirely based on estimates. Manufacturing Overhead Cost of Goods Sold Cost of Raw Material Direct Labour Cost. Calculate cost of materials.

390000 200 per MH 60000 MHS 500000 375 per DLH 80000 DLHs 390000 120000 500000 300000 510000 800000 Step 2. 390000 200 per MH x 60000 MHS 500000 375 per DLH x 80000 DLHs 390000 120000 500000 300000 510000 800000 Step 2. 72 040050090 6 parts 54 150 1 hour150 0301 unit030 5415003072 To get the total cost allocated to each sprinkler you must take each overhead rate and multiply it by the planned activity for each item.

To compute the overhead rate divide your monthly overhead costs by your total monthly sales and multiply it by 100. The finance head is referring to indirect overhead cost which shall be incurred irrespective of whether the product is manufactured or not. Direct materials direct labor manufacturing overhead total manufacturing cost.

Is computed by dividing the total estimated manufacturing overhead cost for the period by the estimated total amount of the allocation base as follows. With 150000 units the direct material cost is 525000. Assembly Department Overhead Cost Y.

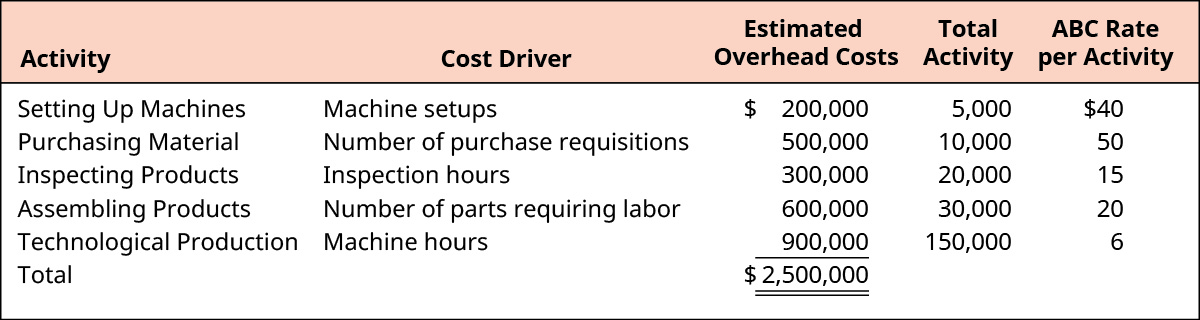

The direct method of cost allocation is the most popular method used for allocating costs. Applied overhead for each department Departmental overhead rate x Actual activity using the same driver used to calculate the rate If you used estimated machine hours to calculate the rate use actual machine hours. The cost per setup is calculated to be 500 200000 of cost per year divided by 400 setups per year.

Estimated Manufacturing Overhead Cost 30 million 10 million 5 million 3 million. Milling Department Overhead Cost Y. Total manufacturing Overhead cost Milling Department Assembly Department 500000375X50000 DLHS 500000187500 390000 687500 Calculation of Overhead rate Milling Department Assembly Department 39000060000 68750050000 650 per machine hour 1375 per machine hour Amount of overhead applied from both department.

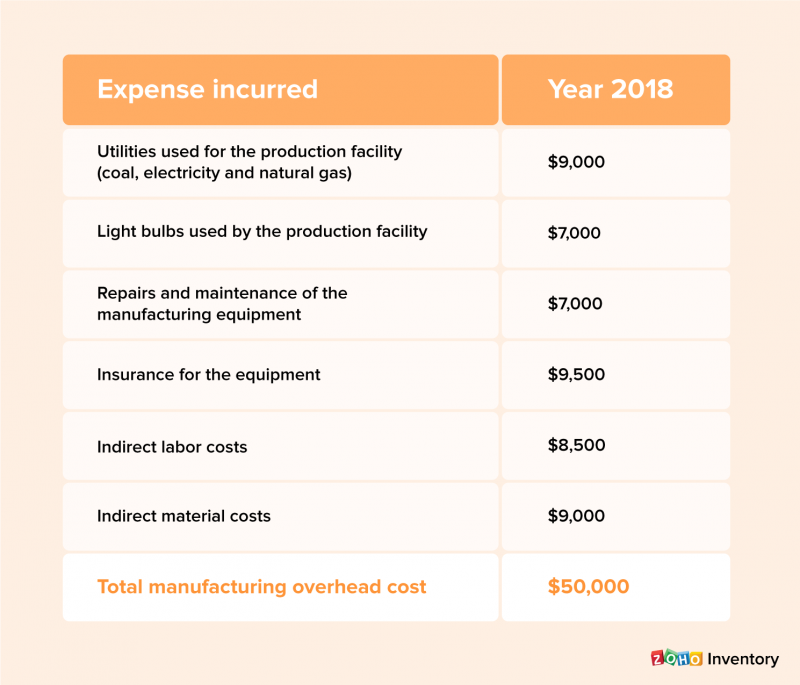

Accounting questions and answers. Predetermined overhead rate 80001000 hours. The Manufacturing Overhead is composed of indirect labor costs for maintenance wages amount to 9000 in a quarter and warehouse wages 12000 in a quarter additional materials such as glue and sandpaper 800 rent 6000 per quarter insurance 200 per quarter and an equipment depreciation of 2400 a year ie.

Estimated Manufacturing Overhead Cost 48 million. For example take the estimated factory overhead for. Manufacturing Overhead 180 million 80 million 50 million.

Calculate the predetermined overhead. Add up the overhead from each department to calculate the total overhead. Begin by selecting the formula to allocate overhead costs.

Therefore the manufacturing overhead of ASF Ltd for the year stood at 50 million. Under activity based costing 200000 of the overhead will be viewed as a batch-level cost. If you used direct labor hours to calculate the rate use actual direct labor hours.

The direct labor cost is 1500000. Calculate the estimated total manufacturing overhead cost for each department. Then add all four cost components together.

And the manufacturing overhead applied is 750000 for a total Cost of Goods Sold of 2775000. Calculate the estimated total manufacturing overhead cost for each department. Estimated overhead costs Estimated qty of the allocation base allocation rate Mixing 501500 170000 295 Packaging 219000 60000 365 Requirement 2.

To calculate overhead costs simply divide the total by the calculation base with the latter referring to the direct costs eg. How to calculate total manufacturing cost. Total amount of the allocation base.

Predetermined overhead rate Estimated manufacturing overhead costEstimated total units in the allocation base. For example if your company has 80000 in monthly manufacturing overhead and 500000 in monthly sales the overhead percentage would be about 16. Milling Department Overhead Cost Y.

Determine the total amount of overhead allocated in October. To calculate the total manufacturing overhead cost we need to sum up all the indirect costs involved. Total manufacturing overhead cost est.

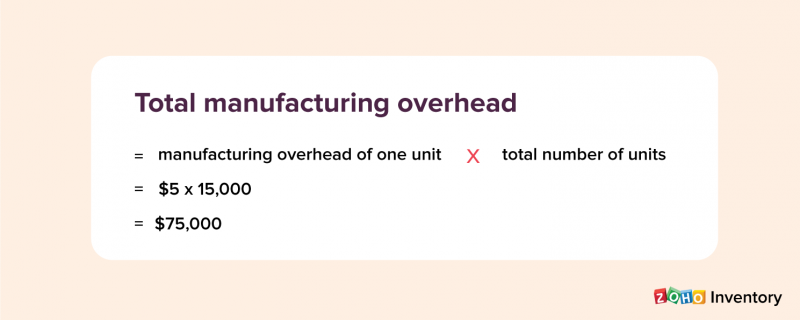

Estimated total manufacturing overhead cost 86200 Estimated total machine hours 10000 MHs Predetermined overhead rate 862 per MH b. So the total manufacturing overhead expenses incurred by the company to produce 10000 units of cycles is 50000. In the following example calculating the overhead rate for the material overheads is done by dividing the total overhead cost of 30000 by the calculation base of 100000 giving a rate of 03 30.

The overhead applied to products or job orders would therefore. Manufacturing Overhead 50 million. The second step is to combine the estimated manufacturing overhead costs in the two departments 12400 73800 86200 to calculate the plantwide predetermined overhead rate as follows.

Here is the formula to measure total manufacturing costs. Predetermined Overhead Rate is calculated using the formula given below.

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Pin On Construction Civil Engineering

Manufacturing Overhead Formula Step By Step Calculation

Average Total Cost Formula Step By Step Calculation

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Solved Abc Floral Shop Solutionzip Floral Shop Solutions Floral

Predetermined Overhead Rate Formula How To Calculate

Manufacturing Overhead Formula Step By Step Calculation

Solved China Plant Solutionzip Chinese Currency Currency Solving

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Calculate Activity Based Product Costs Principles Of Accounting Volume 2 Managerial Accounting

How To Calculate Manufacturing Overhead Costs

How To Calculate Total Cost 13 Steps With Pictures Wikihow

Pin By Dennis Rixx On Best Grades In 2022 Good Grades Accounting Exam Study Course

Predetermined Overhead Rate Formula Calculator With Excel Template

Estimate At Completion Formula Earned Value Management Formula Pmp Exam

Comments

Post a Comment